(Intro to) Jpeglysis #1 - the best BUY in NFTs, Insrt Finance, Parsec review, and a glimpse into Web3 Gaming.

Enter Premier NFT Research

Dear valued readers,

I return to my substack after a long period of writooors block, with a renewed interest in the inquisitive roots that got me here. Way back when I was merely a spectator of the timeline, I focused most of my days on reading and researching. In fact, that’s how I initially got a small following - I had done some research on mfers and created a dune dashboard that, to my surprise, got some attention. After which, I got so tied up in the jpeg sauce that I ceased my research efforts and instead spent more time socializing. As fun, as it has been, I was always a bit bored. There are only so many times you can hear the same story from NFT NYC until you want to jump off the Brooklyn Bridge (at the next NFT NYC).

Fast forward to a couple of weeks ago, and I found myself doing some Web3 gaming research for my job. Then it hit me - I really, really enjoy doing research. I sat there for hours, completely unbothered just enjoying the different rabbit holes. That’s when I realized I needed to get back to generating some research output.

So that’s what I am going to do from now on - I’m challenging myself to put out regular research on various topics within the NFT space. I know you’re supposed to specialize but to be honest, the rabbit holes are not that deep. I call this beautiful experiment - Jpeglysis. Otherwise known as, The Analysis of Jpegs - clever, I know.

Below are some topics I plan on covering:

Profile Picture (PFPs) Market

Web3 Games

Tokenomics

NFT Collections

Gameplay

NFTfi(ance)

Borrowing/Lending

Shards

Options/Perps

Research/Valuation Tools

With that being said, let’s jump into post #1.

gm gm -

In this post, we will cover the following topics:

The market’s MOST slept on PFP

Insrt finance and what the heck a shard is

Why Parsec is the best NFT market visualization tool

Mapping out the Web3 Gaming space

The market’s MOST slept on PFP

One of the first projects that I came across when I got into the PFP game was Cryptoadz. At the time I was probably most attracted to their rising floor price (damn veblen goods) but after over a year of starring at them, I can confidently say…CROAK!

Seriously though, I firmly believe Cryptoadz will age INCREDIBLY well as the PFP market matures. Cryptoadz has deep-cut cultural roots and I think any serious NFT collector would be a fool to not own at least one. Cryptoadz, as a community, lacks any and all infrastructure. So much so that they make mfers look like a Fortune 500 company. But their collector base and rich crypto history make it an attractive buy at these prices. I have made it a point to examine the Cryptoadz floor every day for the past 3 months and feel confident in claiming we are at the bottom.

Before we make the investment case for the Toadz let’s look at their rise first.

“As part of the Gremplin modus operandi, I was live commenting on [Weird Whales] by just quickly creating the first animal that came to mind and making a Punk version of it,” Gremplin tells nft now. “That was, initially, Freaky Frogz.”

After less than a month of his Toadz concept art floating around Discord and Twitter, Gremplin launched an official Twitter account in early August. As for the evolution of the project itself, the Toadz artist says it wasn’t he who took the reins during CrypToadz’s development, but a group of his friends.

“Some friends kidnapped me and made the Toadz project a reality, with expectations that it was mostly a proof of concept for them working together as a team,” Gremplin tells nft now. “I think that proof of concept turned out fairly well!” - NFT Now

The Case for Acquisition: The Cryptoadz floor fell below the 1eth mark back in early March and has been sideways with a downward slant ever since. To be crystal clear, this is a long-term buy based on its cultural value. At a high-level Cryptoadz are more like an in-vouge fashion item than they are some budding financial asset. Since Cryptoadz doesn’t really do anything (no community or central project) we can’t count on the meme spreading too far on its own. In my opinion, this explains the current price level - holders bought into Cryptoadz expecting a CryptoPunk-esque rise in price but, was met with the harsh reality that the digital assets which derive their value from their place in the culture, move much slower than hyper-financialized ones.

The bet, is that when the next cycle comes around Cryptoadz will be a “historical NFT” (that hurt to type out) and the allure will come from its impressive holders and the “OG” signal that accompanies ownership.

Target: I think it’s possible that Cryptoadz regain their ATH. The timeframe on that would, of course, be multi-year. My more conservative estimate is 2eth. That’s a solid 3.5x from current levels.

Insrt finance and what the heck a shard is

What is it?

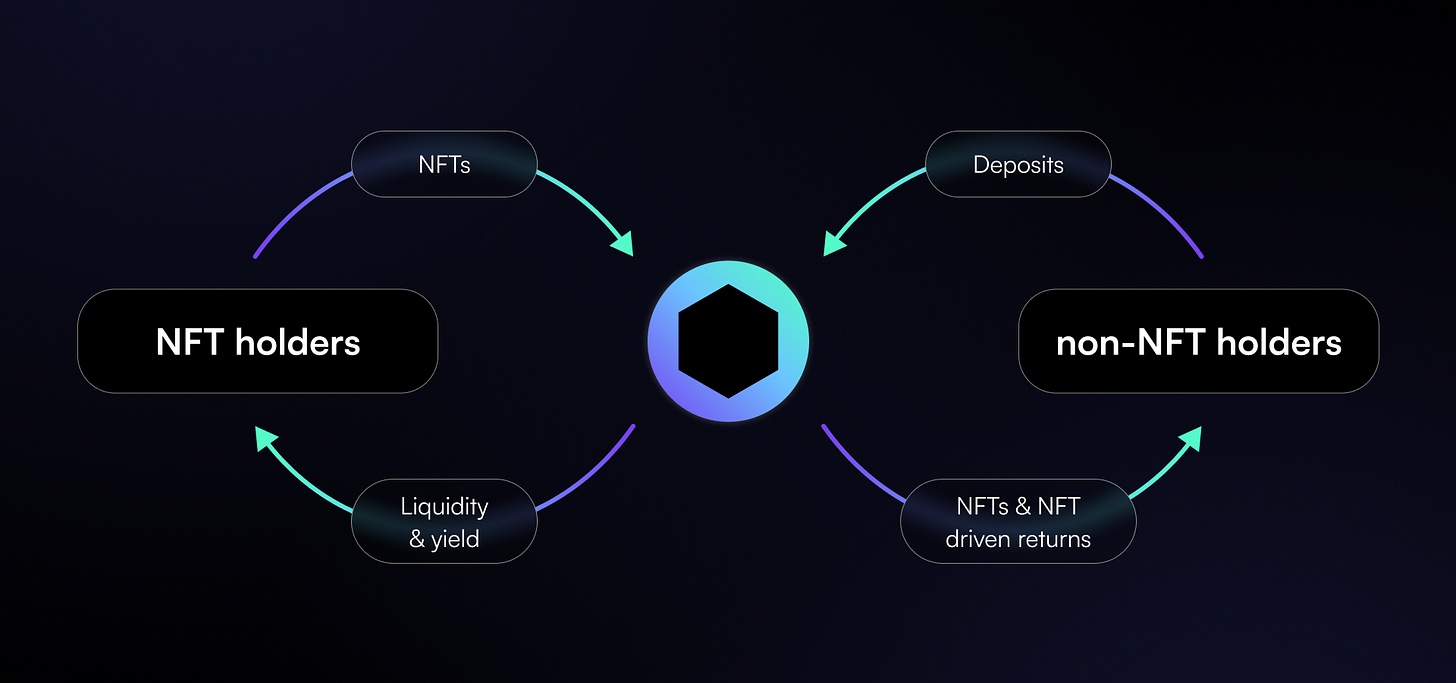

Insrt Finance is NFTfi(ance) protocol that aids users in accessing returns from “blue chip” NFTs like Bored Apes and CryptoPunks. Users can purchase a fraction of a “blue chip” NFT, which has been borrowed against to farm yield and redeem their share of the earned yield.

How does it work?

ShardVaults are Insrt’s first product - they acquire Bluechip NFTs and pay yield to users for becoming partial owners. So, if you don't currently hold any NFTs, ShardVaults give you a low-cost entry point into some of the best, most sought-after NFT collections out there. Then these top-tier NFTs, are put to work in the NFT finance scene to make a bit of extra cash for everyone who's part of the Vault.

But what if you already own some NFTs? Well, ShardVaults provide a way for you to unlock some liquidity from your NFTs without giving up all of your stake. So, for instance, you could shard, or split, your NFT into parts and sell off, say, half or two-thirds of it.

Each Vault contains specific assets that are decided on before it's even set up. And once a Vault is filled up, its contents stay the same. There's no chopping and changing. If you want to get your hands on more NFTs, no worries – new Vaults are constantly being created to give more people the chance to get involved.

Is it worth it?

The APRs for the vaults are well advertised and at the time of writing the highest available is for the CryptoPunk vault at just 2.81% APR.

Let’s face it - this is pretty low. Sure, it’s cool but 2.81% just isn’t enough to get me excited. Of course, it should be noted that the defi tools underpinning this app are in a low returns environment, and as the market comes back we can expect to see APRs rise but still 2.81%... My bank is offering higher rates than that.

The other caveat is that you are earning 2.8% on a “number go up” asset, which in theory will age well. Something to think about.

All the smoke:

I’m old enough to remember when “fractionalization” was all the craze, and despite some best efforts it just never really took off. My theory is that the allure of owning a digital asset trumps the allure of owning a *part* of a digital asset, no matter the price difference. Bitcoin vs Dogecoin is a great example of this unit bias at play.

As for the idea, app, and execution - it’s all solid. I just am not personally interested in owning a fraction of a squiggle. I don’t think we are at a point in the market where people yearn so badly for certain NFTs that they opt for partial ownership. When thinking about fractional ownership I always think back to Timeshares as a concept. The idea wasn’t even thought of until the 1960s in Europe and didn’t make it to the States until the 1970s. I try to avoid making skeuomorphic analogies but “splitting ownership” of property with strangers took a long time to come about and it feels like digital assets will repeat that timeline.

Why Parsec is the Best NFT analytics tool

There are a seemingly endless amount of crypto analytic tools out there and I have this weird thing where I must try them all. So I figured as I trial these tools I would collect my thoughts and add them to these posts in an attempt to save yall some money. So we begin with my favorite tool to date….Parsec.

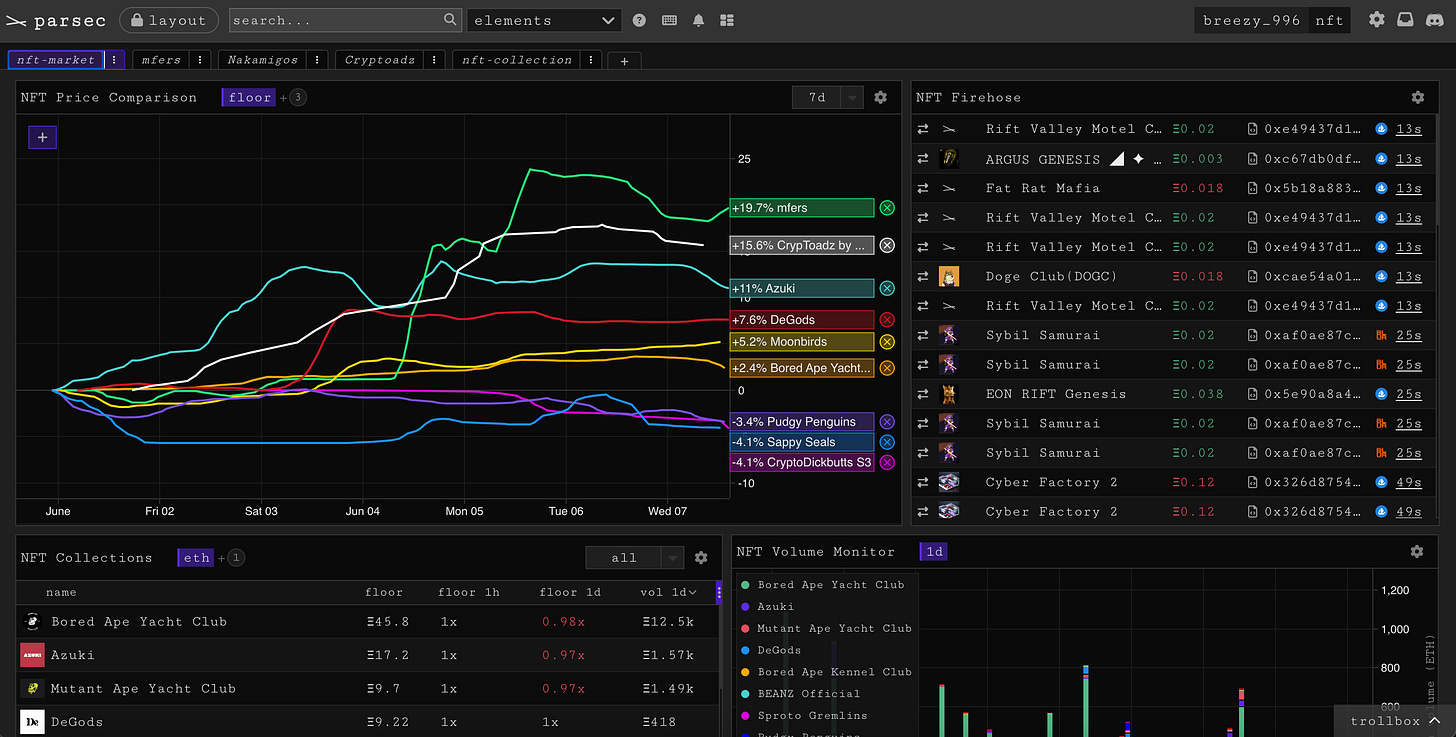

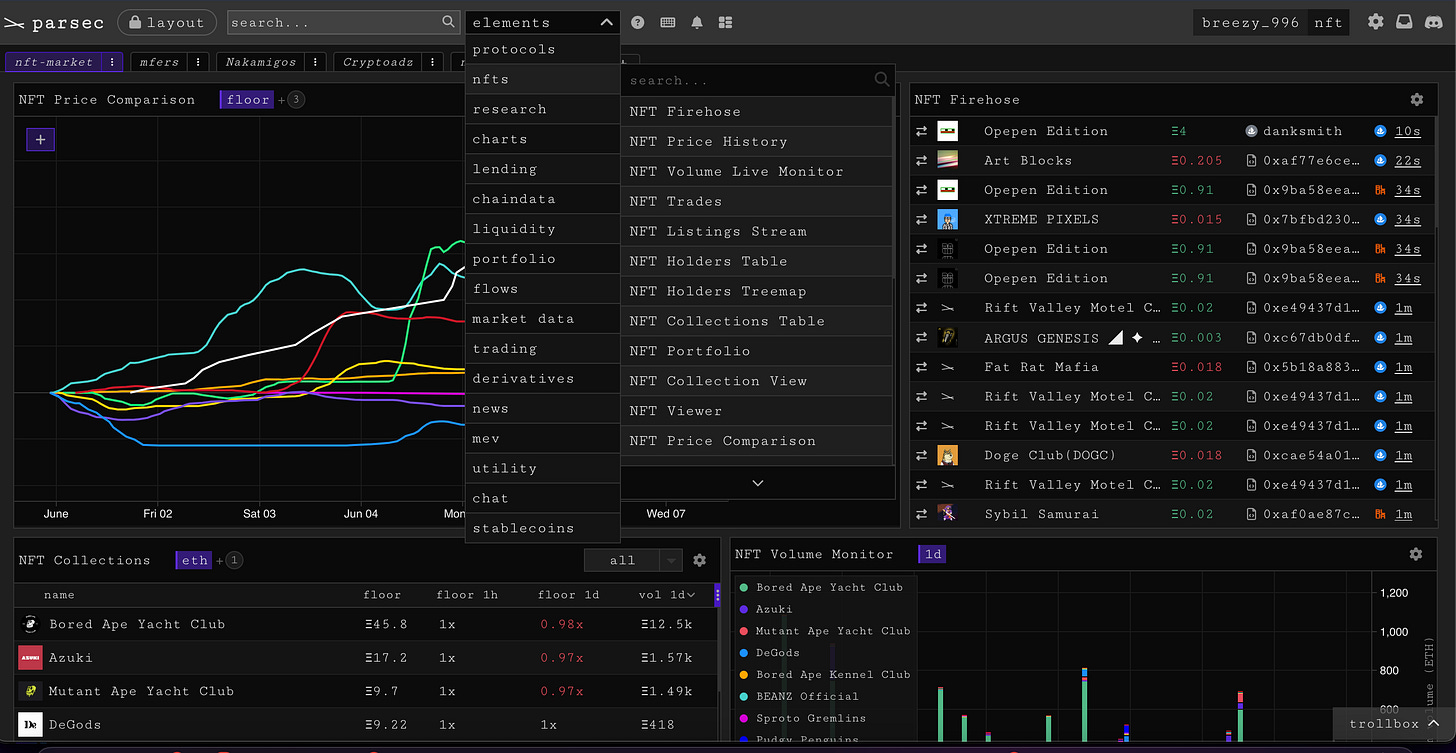

Parsec advertises itself as the “Pro Terminal for Onchain Markets” and boasts about its rich tooling for DeFi, NFTs, Chain Data, and Lending. I have only ever used the NFT features so this review will only be for that section.

Price: $60/month or $600/year. Can pay in fiat or crypto.

This is steep but not an uncommon price point for software like this. For reference, Nansen is $150/ month or $1,200/year.

The UI is suuuuuppppeeerrr clean. It definitely gives off that “pro trader” feel which is nice. It’s also semi-customizable. Each window is a moveable module and this helps a lot since I am pretty picky about how to organize my screen.

The list of “tools” for the NFT data set is quite extensive and I haven’t really been able to find any data flow that I desperately need but isn’t available. If there ever was some data that you needed, you could always try sourcing it yourself in their Playground tool.

One of the main features I got Parsec for, was the chart view above. Being able to see the sales plotted out in a way that almost tells you exactly what is to come has proven to be profitable for me. For example, notice the steep drop in the yellow line around May 7th, followed by a frenzy of above-floor purchases. Patterns like these are much easier to see with this type of chart view because you can easily see the swing in the market as the sales flip from “bids” to “offers” and vice versa.

Concluding Thoughts on Parsec - Parsec is not going to make you millions and it’s unlikely you’ll get any redeemable value out of it unless you obsessively watch it throughout your day. That being said, I am definitely ahead of retail when projects start to pump/dump and have noticed that I have a better understanding of how and when the price began to turn on projects overall. For that reason, I’ll likely keep using it.

If you want to try out Parsec, consider using my referral code: https://parsec.fi/r/breezy_996

Mapping Out the Web3 Gaming Space

To set the stage I am currently building a product in crypto payments but specially geared for Web3 gaming. As a result, I have spent countless hours studying the market, speaking with founders, and attending conferences on the subject. All of this involvement has brought about some revelations.

“The Case Study”: This is by far the most important topic in the Web3 gaming space at the moment. In short, it refers to the need for thesis validation. The popularized claim is that blockchain is an inevitable movement in gaming, yet we still haven’t seen proof that games need blockchain. Everyone in the industry is essentially waiting on someone to develop a badass game that validates the underlying thesis and greenlights the next wave of capital and labor deployment. Why is this important? Well, there’s basically no way to tell which L1/2 or infrastructure will win out because, quite frankly, no one cares. They just need a win. The takeaway? Keep an open mind when assessing games, there’s no clear path.

“Triple A Games”: Initial attempts at blockchain-based games were trolled for their simplicity and lack of content that the web2 gaming space is accustomed to. As a result, there was a palpable vibe shift in the market towards a Triple-A title becoming the first game that validates the blockchain thesis. My hot take is that the most successful games won’t be Triple-A and instead will resemble the Defi Kingdoms of the world. Games that find interesting ways to utilize the blockchain while offering some sort of yield farming will convert normies and degens into “gamers”. I am not suggesting that Triple-A games will fail, I definitely believe that there are some coming down that pipe that will succeed but crypto always offers this little “twist” on web2 world assets and concepts. Take Defi, its base principles are rooted in finance but users are more interested in products that add a novel crypto spin to existing ideas. For example, perpetual swaps. My bet is that gaming will follow suit, people want to gamble on new things that purport to be on the bleeding edge. Triple-A games are too safe. They will exist but they won’t be where degens take liquidity.

Games that I find interesting:

Shrapnel AAA

Star Atlas AAA

Illuvium AAA

If you found any of this information interesting or useful consider sharing this post on Twitter or privately with your network.

Let me know if there are any topics of interest that you’d like to learn more about.

Have a great Sunday evening and week ahead!