Más Cope

Everyone talks about "not knowing what you don't know" but almost no one ever talks about "knowing what you do know".

In today’s doom and gloom market/macro landscape, it becomes harder and harder to feel confident about the future state of our bags, especially if they are filled with these silly and worthless jpegs.

So, in the post below I will wrestle with the different logical paths one may take to Valhalla and will be sure to cope extra hard.

Shall we dance?

IT WAS ALL A DREAM…

I have been seeing this notion that Blur is ruining the culture due to its tendency to reduce NFTs down to just “shitcoins with pictures on them”. Let me be careful to not mince words here - WE LIKE THE SHITCOINS WITH PICTURES ON THEM.

This concept that the culture is being “reduced down” to some lower form is a classic case of “missing the forest for the trees”. I welcome the differing opinions but fear they are more concerned about what happens in the immediate without appropriately understanding that this marketplace phenomenon is merely an intermediate stop along an otherwise long and winding road (to Valhalla).

The “blur-doomers” are too focused on a moment in time, and not paying attention to the evolution of the market. The dust is still settling on this new asset class and a natural result of that is temporarily murky waters. But rest assured, over a multi-year period Crypto narratives never cease to evolve and surprise us and we should expect NFTs to be no different. I make no claim to have the answers about what this means for the asset class as a whole, and it may end up being negative, but in any case, I calmly prescribe patience as we watch NFTs ascend their respective helix.

BESIDES…

Shitcoins without pictures on them traded for a decade and made many fortunes, we should be so lucky that we are in the crypto markets during the time when shitcoins evolved to have pictures on them. Truly a notable epoch in the history of art, tech, and markets.

A primary residence is an asset you consume.

Fine Art is an asset you preserve.

Jpegs are assets you enjoy.

-Breezy

In the abstract - imagine ten years from now. Will there be shitcoins trading on a decentralized market? Well, if the past ten years are any indicator, we can be certain that the next decade will be accompanied by *some* shitcoins. So let’s assume that there are 100 meaningful NFT collections that rise to the top of the market from 2021 to 2030. If each has an average supply of 10k tokens, that’s only 1 million units (shitcoins with pictures on them) that hit the market over 9 years. Probably a low estimate if I had to guess but nonetheless powerful in demonstrating how absorbable this NFT market is in the grand scheme of things. By my estimate, there are currently ~30 projects that have the potential of lasting until 2030, and many face execution risks that will almost certainly wipe out half of them. All that to say, there’s a lot of capital up for grabs and not many projects positioned for the long term.

NIKE VS MFERS

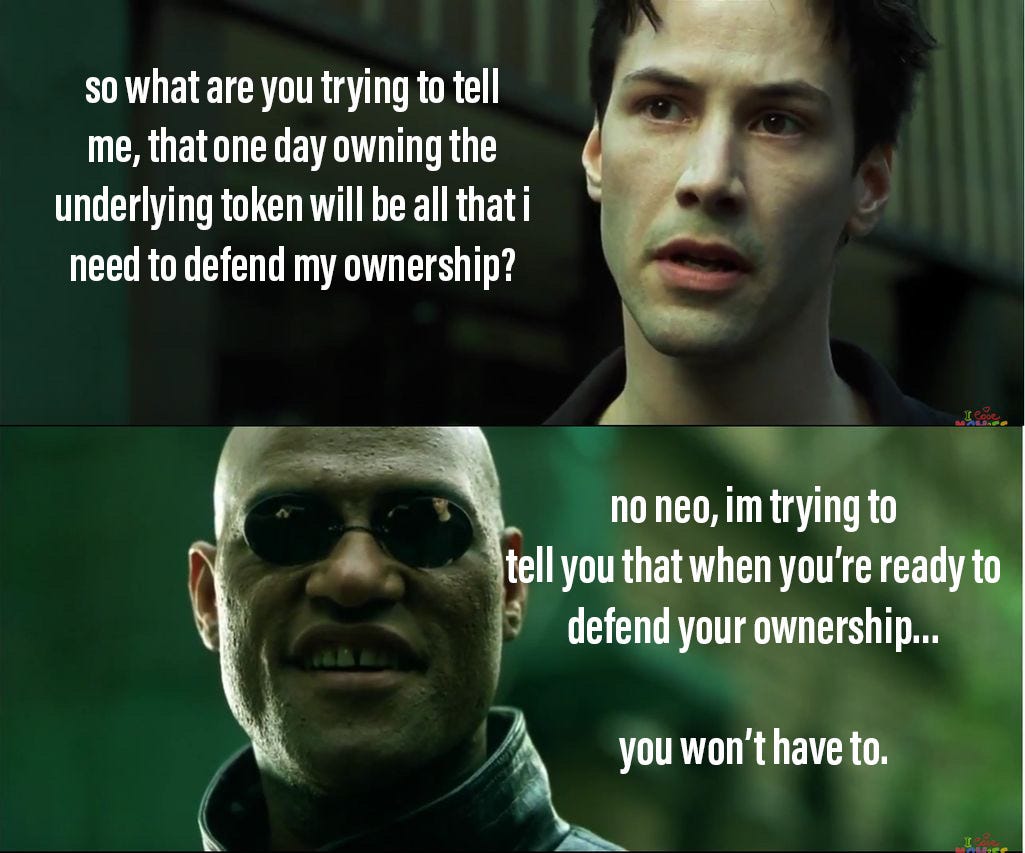

In an attempt to convince someone of the value attributable to “intangible assets,” I heard an extremely interesting meta-concept. After explaining that publicly traded companies value intangible assets on their balance sheets, like Nike and its iconic “Swoosh”, my friend was quick to ask the following question:

“Is it the Swoosh that’s valuable or the feeling that the Swoosh’s imagery invokes?”

One could spend a lifetime pondering a question like this but needs much less time to capture the general essence, which is to say that the true value of intangible assets lies in the strength of the emotions they are able to invoke. This is not a terribly nuanced concept as this is how “branding” works yet I find it important to note when dealing with such assets as PFPs. So how does this relate to Mfers? Well, similar to the “Swoosh” the overarching goal of PFP projects is to achieve a status like that of the “Swoosh” and be capable of invoking such strong emotions with the iconography that owning the underlying token is financially advantageous.

BUT…there is one problem. Since Mfers are CC0, owners do not get special privileges for owning the assets and instead share the same legal protections, as they pertain to profits and commercial usage, as any other person in the world. This is where the PFP==Brand concept falls flat. Almost every normie I talk to gets hung up on the “right-click save” problem of NFTs.

Surprising as it may be, this problem isn’t unique to Mfers or any other CC0 NFT collection, it’s actually shared by all images on the internet, NFTs and otherwise.

But we are here to cope, so let’s cope.

The issue is easy to see, “why should I own this image if I can’t protect my ownership?”

This is actually a pretty simple economic problem. As digital items grow in value, their owners will naturally prefer mechanisms that help reinforce those valuations. An example of this would be preferring a Twitter that lets you verify your PFP as opposed to a Twitter without this feature. Eventually, as more value flows to digital assets it becomes more important to verify who owns what, thereby adding more pressure to the applications to verify ownership and on spins the pinwheel.

Even in the event that all major apps require you to verify ownership of digital assets, one could still “use” or “enjoy” your digital items without your permission..and this is OKAY. The idea is that while they cannot be completely deterred from using your asset, they will largely be unable to use it where it matters and that is sufficient to quell the “rick click saver” argument.

Assuming you’re on board with the arguments made above, which can be summarized in the following points…

NFTs (shitcoins w/ pictures) can absolutely be absorbed by the crypto market and any notion to suggest otherwise is ignoring over a decade of historical data that supports this thesis.

The “right-click save” argument is a simple economic problem that will see a resolution from technical changes driven by marketplace demand.

there’s still a hurdle to jump through, namely, which NFTs will win in the end?

To that I say - Welcome to the game, anon.