Views From The Fourth Wall

Hopefully we don't share fate with Humpty Dumpty

‘Two Roads Converged in a Wood, and We all Took that One’

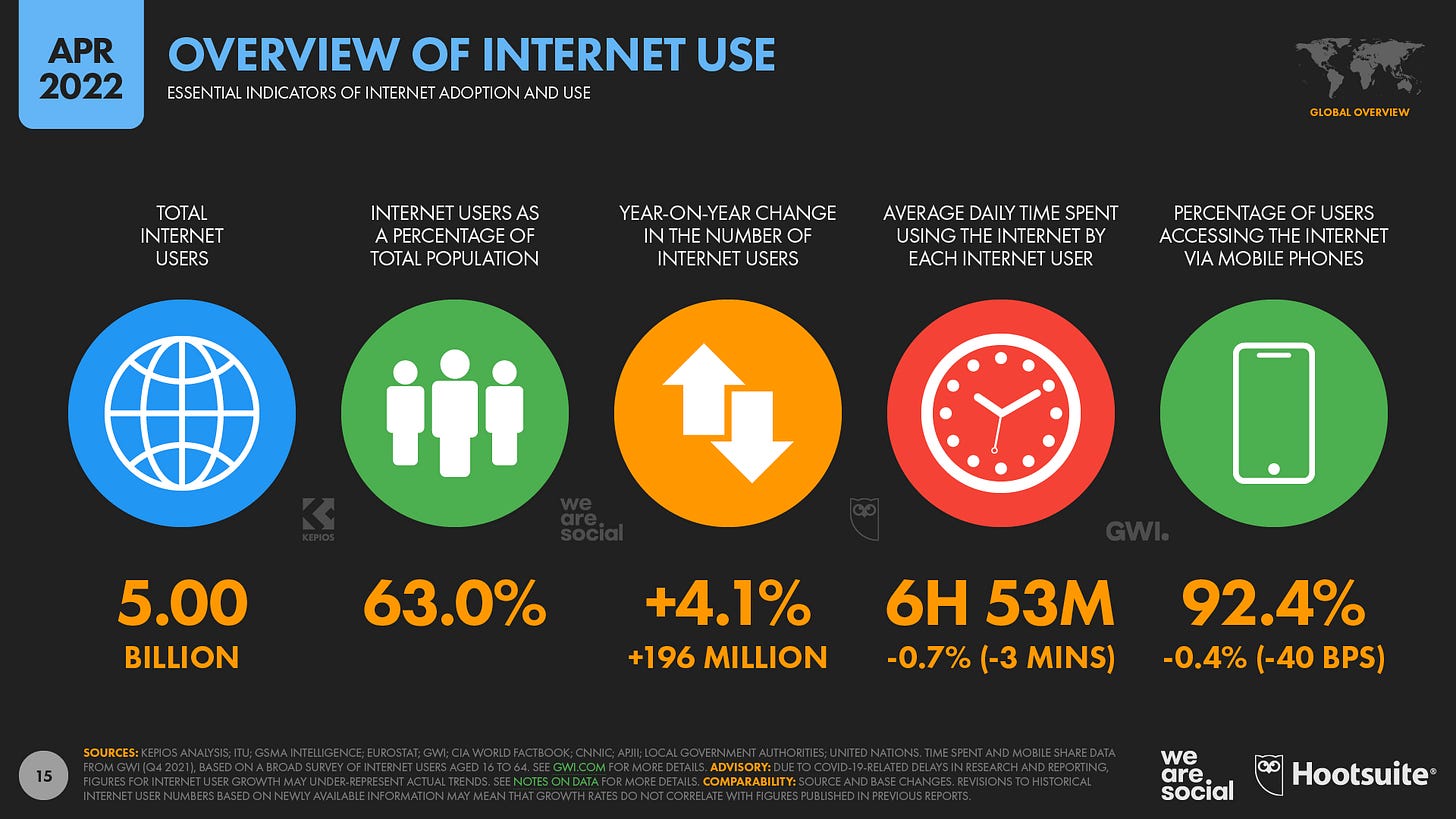

The internet has 5 billion users with the average user spending over 40% of their time awake, online. By now, it’s appropriate to say, the internet has become the interface for the human experience.

Even with all these people and all the time they spend online, it’s still rather uncommon, some might say foolish, to own digitally native assets. But how come? Doesn’t it make sense that you would own stuff in the location where you spend a lot of time? Sorta like keeping a toothbrush at your girl/boyfriend’s house. Or imagine you’re a [digital] conquistador, if you arrived at an otherwise uninhabited place wouldnt’t you start to claim all the cool shit before the party arrives?

I believe there are two lines of thinking as to why owning digital assets isn’t more of a “household” activity …

the first is rather simple - it’s a brand new concept. Sure bitcoin has been around for 12ish years, but for much of that time, it was a thing for criminals and nerdy hobbyists. It’s only recently that people have begun to seriously treat bitcoin as a store of value, and if the markets are any indicator many people still don’t understand its “intended” use case. So as we can tell from the canary in the crypto coalmine (bitcoin), people have still not accepted that digital assets are a new and separate class.

The second line of thinking is less of a cop-out. If we’re being honest (something I pride myself on) the crypto trope, “it's too early” sounds a bit delusional - how long can it be too early? I am not saying I don’t believe we are early just that there needs to be better logic to support that statement → WHY are we still early?

Two responses make up the lines of thinking that tie back to our initial question:

We aren’t early, we are wrong.

People don’t understand what to do with digital assets and they won’t buy them until they do.

My bias will only allow me to entertain number 2. So here it goes.

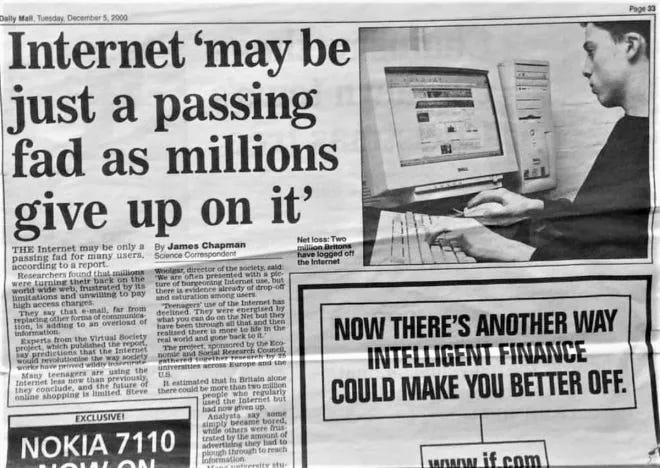

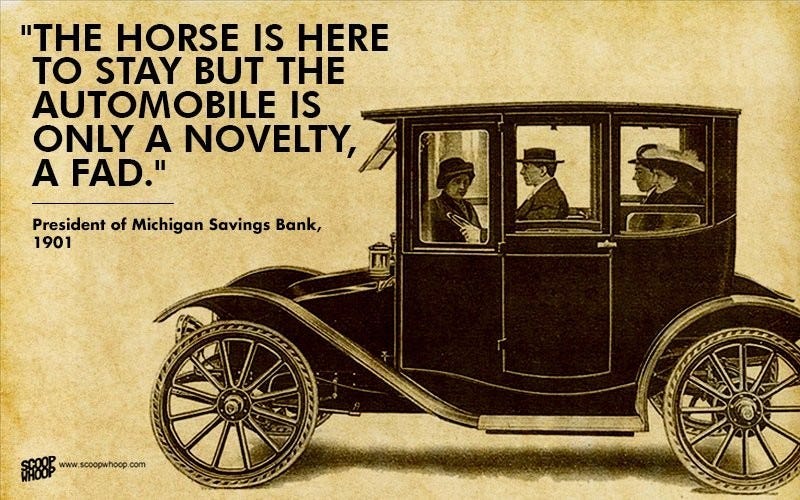

The concern is valid, for many digital assets, there is little to nothing to do with it, and I would be remiss to ignore how unattractive this makes it given the average price tag. However, this is only a concern if you are strictly applying investor logic meant for the physical realm. It should be noted that this seems to be a recurring theme when humans transition from one technology to another.

When thinking about what assets will constitute “digital real estate” it’s important to let go of some factors that matter in the real world. For example, “can I live in it?” or “can I rent it out?”, instead, use the extensive history of the internet to identify themes and try applying a more abstract definition of value where a concrete one isn’t readily available. This is where I believe Punk6529’s “memes > land” idea comes beautifully into play. To be clear, I am speculating on this anon’s idea and its meaning I do not actually know.

Over time the items on the internet that have held the most value are images, symbols, and ideas. So as far as I can tell, Memes = Digital Real Estate. It is only a recent development that we can actually own these items, which is why it’s plausible that we still don’t understand their true value or utility. Even so, as society progresses the idea of “value” becomes more abstract - stocks are a long way from trading cows for protection. With this logic, it’s safe to say that popular images/symbols/ideas provide some value to users on the Internet. In many ways, these items provide more value to more people and in less time than many physical assets. So even though it doesn't provide shelter or an easy path to monetization it is true that these items sit at the intersection of the largest audiences and capture significant attention due to their imagery or narrative. Is it not the case that the most expensive cities in the world also happen to be the most globally populated and have the richest histories? Why wouldn’t this apply to the concept of digital real estate?

It appears there is a massive opportunity to not only acquire important art (which I’m also passionate about) but to correctly identify and acquire “Digital Real Estate” before people realize this shit is basically free99.

To fully understand there are a few moving parts:

Governments will transition their “money” to a blockchain (not necessarily public ones). This opens the door for cryptoization of the world.

People are spending more time online not less. Because we all live online, the internet not only helps distribute culture but also becomes it.

The concept of “value” grows in abstraction as society advances.

A high standard of living (physical) is synonymous with “on-demand”. Humans are owning less physical stuff - this unconsciously makes room for more digital assets.

I didn’t touch on all of these parts, leaving some open for future articles, but I hope now there’s at least a glimmer of light at the end of the dark tunnel recently filled with bears. My goal was simply to provide a base case for why someone might invest in these weird digital assets. One thing I want to be clear on is that I don’t necessarily think this opportunity is reserved for jpegs/memes, it may even be the case that jpegs end up as the least interesting things to own, but from where I sit on this wall it seems that they are the signal not the noise.

Cheers,